Fed-Up With The Fed, Libertarians Buy Into Bitcoins

Primary tabs

In an interview with Michael Israel, Kenyatta DaCosta discusses how the Fed is harming the economy by manipulating the money supply, and how bitcoins could provide protection against such manipulation. The photograph, which was taken by Michael Israel, is of a Bitcoin Miner, a special computer that generates bitcoins, from 2012. (Audio: Michael Israel; Photo: Michael Israel)Ever since Ron Paul railed against the corruption of the Fed, many libertarians have tried to find a way to eliminate the power that the Fed holds over the American economy. Some have also searched for currencies that could not be easily manipulated and facilitated free and open trade without the need for governmental regulators to control every aspect of the economic system to allow on-line trade to occur. Bitcoins provide one tool that could allow trade to occur without requiring a centralized banking system to control the currency that people use to enable free trade. The Great Depression was caused by the Federal Reserve (Fed) trying to stop a series of banking runs after the stock market crashed in 1929. Before the establishment of the Fed, if one or two banks closed due to mismanagement, other more stable banks would be able to keep the economy afloat as the more stable banks too over operations for the banks that failed. According to economist Milton Friedman, the banks closing due to mismanagement would have been more chaotic in the year the closure happened, but the economy would have recovered in about a year. Because the Fed tried to stop the poorly performing banks from needing to close by throwing money at the problem, by printing more and more money, the Fed eventually destroyed the stability of the economy, and got short-term stability, at the price of a long-term depression and systemic failure of the economy. By manipulating the interest rates to keep the rates low to foster borrowing to bolster the economy the Fed caused the housing market to rise faster than it should have risen in a natural free market which resulted in a crash and burn after the Fed could no longer keep the rates low enough to keep people borrowing more and more money. The Fed was running a giant ponzi scheme, and could not keep the scheme going because too many people wanted to cash out; the Fed's scheme would only work if they could get people to keep on wanting to borrow money to keep the economy going. According to Kenyatta DaCosta they're several ways of taking control back from the Fed and move the economy towards decentralization using cryptocurrencies such as bitcoins: spread infomation about, invest in, or mine for bitcoins or other cryptocurrencies.

Two bitcoin miners from 2012. It has become so cost prohibitive to mine for bitcoins because too many other people also mine for bitcoins. The miners used in 2016 are a hundred times larger than these units from 2012. Mining is now only profitable in areas with low-cost electricity such as Iceland. In other areas, the cost of electricity used is higher than the value of the coins generated.

Two bitcoin miners from 2012. It has become so cost prohibitive to mine for bitcoins because too many other people also mine for bitcoins. The miners used in 2016 are a hundred times larger than these units from 2012. Mining is now only profitable in areas with low-cost electricity such as Iceland. In other areas, the cost of electricity used is higher than the value of the coins generated.

(Photo: Michael Israel)

The best way to aquire bitcoins is to go to a bitcoin broker such as CoinBase and buy a few dollars’ worth of bitcoins. Mining used to be a very easy way to get bitcoins, but the popularity of bitcoin mining has made it hard to get coins by using specialized hardware to generate the coins, a process called bitcoin mining, unless you live in an area with cheap electricity such as Iceland. According to Kenyatta DaCosta: "Some people mine for bitcoins not out of a desire to profit and get rich quick, but rather to help maintain the bitcoin community and to ensure people can perform transactions using bitcoins."

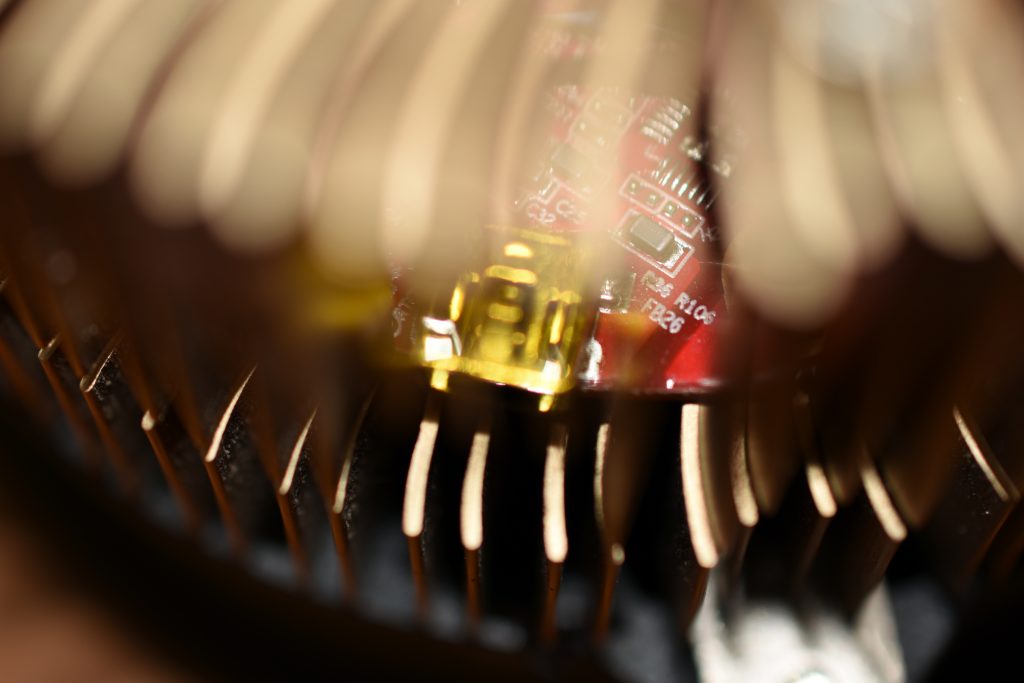

A close-up view of a bitcoin miner from 2012. Part of the circuit board is shown. The heat sink and fans needed to cool the miner off make up the bulk of the size of a miner.

A close-up view of a bitcoin miner from 2012. Part of the circuit board is shown. The heat sink and fans needed to cool the miner off make up the bulk of the size of a miner.

(Photo: Michael Israel)

Anyone who wants to learn more about the Fed can either read "The Creature From Jykell Island" by G. Edward Griffin or "End The Fed" by Ron Paul. Anyone who wants to learn more about bitcoins or other forms of cryptocurrencies just needs to do a Google search; They are two books "Bitcoins For Dummies" and "A Dummies Guide to Cryptocurrencies" for people who would rather read a book than surf the web.